Cryptocurrency sounds like something out of a sci-fi movie, but it’s very real — and very chaotic. Bitcoin, Ethereum, Dogecoin — these digital coins aren’t physical, but they sure have people talking (and making or losing serious cash). Teens especially have gotten curious: is this the future of money or just another hype train?

At its core, crypto is a type of digital currency that lives on something called the blockchain — basically, a super-secure online ledger that records transactions. No banks, no middlemen, just computers solving puzzles to keep everything running. That’s part of the appeal: it’s decentralized, which means no one government or company controls it.

Bitcoin was the first major player, launched back in 2009, and it’s still the king of crypto. People started buying it for a few dollars, and at one point it skyrocketed to over $60,000 per coin. That’s when teens started looking at it like, “Wait… I could’ve been rich?” Now, tons of other coins exist, each with its own vibe, community, and use case (or sometimes, just memes).

Apps like Coinbase, Cash App, and even Robinhood make it super easy to buy crypto — just a few taps and boom, you’re a digital investor. But easy access comes with a warning: crypto is super volatile. One day it’s up 20%, the next it drops harder than your phone without a case. People have made big gains, but others have lost their savings in minutes.

That’s why some adults call crypto a “cash crash waiting to happen”, while others see it as the next evolution of finance. There are legit use cases — like smart contracts, NFTs (non-fungible tokens), and even international money transfers without crazy fees. But it’s also filled with scams, shady coins, and influencers who hype stuff and then disappear.

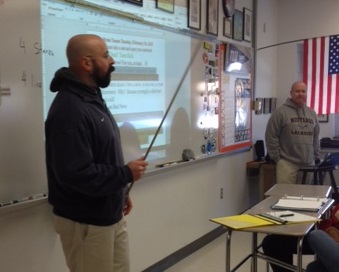

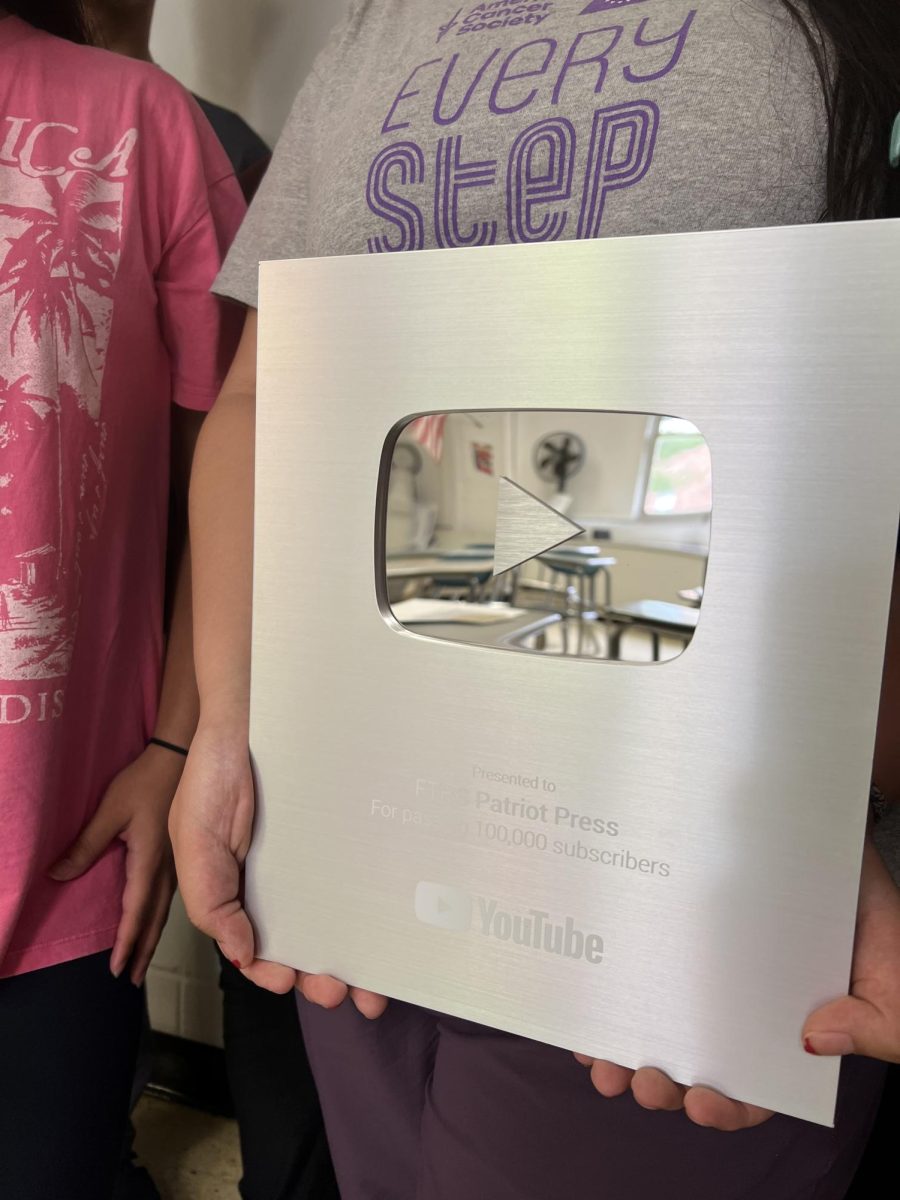

Some schools are even starting to teach crypto basics, which shows how fast it’s entering the mainstream. Financial literacy for Gen Z includes knowing what Bitcoin is — not just how to budget lunch money. And teens who understand this world now could end up running it later.

Still, crypto isn’t something to just YOLO into with lunch money or birthday cash. Experts say never invest what you can’t afford to lose — especially in crypto. It’s more like the wild west of finance: high risk, high reward, and a whole lot of chaos.

In the end, whether it’s a crypto craze or a total crash, one thing’s clear: teens are paying attention. And that means the future of money might just be shaped by the same generation making TikToks and dropping fire sneaker fits. Now that’s something worth watching.